So you just got your first ₱15,000 paycheck as a freelancer. 🎉 Congrats!

That’s the “I can finally pay my internet bill without panicking” level. But here’s the plot twist: the BIR is probably not the first thing on your mind.

Still, the question hangs – at ₱15K gross monthly income, do freelancers need to pay taxes?

Let’s break it down.

Contents

Applicable Taxes for Freelancers (Simplified Edition)

1. Income Tax

The big one. Freelancers pay Income Tax on net taxable income.

Net taxable income = Gross income – allowable deductions/expenses.

Examples of deductible expenses for freelancers:

- 💻 Laptop, monitor, keyboard, mouse (if used for work)

- 📶 Monthly internet bill

- 🔌 Electricity (if working from home, a portion can be claimed)

- 📚 Software subscriptions (Canva, Grammarly, Zoom, Adobe, etc.)

- ✈ Transportation or delivery fees related to client work

- 🏠 Coworking space rental or office supplies

- 📑 Government contributions (SSS, PhilHealth, Pag-IBIG)

Under the TRAIN Law, the first ₱250,000 annual income is tax-free.

👉 For detailed computations, check out Taxumo’s guide on how income taxes are computed.

2. Percentage Tax (3%)

If you’re earning below ₱3M/year and are not VAT-registered, you’ll pay 3% of gross receipts. (Unless you chose the 8% flat tax option below.)

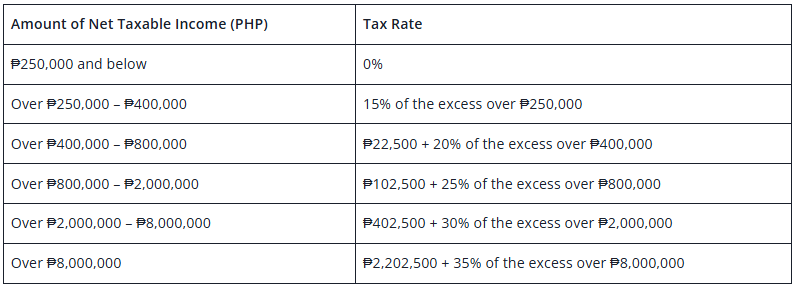

3. Graduated Income Tax (Bracket System)

Based on the updated BIR TRAIN Law Income Tax Table:

4. 8% Flat Income Tax on Gross Receipts

Instead of paying both Percentage tax + Income tax, you can choose 8% on gross receipts (if below ₱3M).

- Better if you don’t have many deductible expenses.

5. VAT (12%)

If you cross ₱3M annual gross, you must register as VAT. That means charging clients an extra 12% and filing monthly VAT returns.

Benefits of Paying Taxes (Even as a Freelancer)

It’s easy to see taxes as “pera na nawala.” Pero may benefits din siya, lalo na kung freelancer ka:

- Legitimacy & Professionalism

– Clients take you seriously when you can issue Official Receipts. - Loan & Credit Access

– Banks, Pag-IBIG, and fintech apps often require your ITR for housing/car loans or credit cards. - Government Benefits

– Paying taxes + contributions = pension, sickness benefits, PhilHealth coverage, Pag-IBIG housing loan eligibility. - Travel & Visa Applications

– Many embassies ask for ITR when applying for visas. Taxes = smoother approval. - Peace of Mind

– No stress about BIR penalties or surprise audits.

Frugal Freelancer’s Take

👉 If you’re earning ₱15K/month (₱180K/year), you’re still exempt from income tax—but you may still need to pay percentage tax if you’re registered, plus contributions if kaya.

👉 As you grow to ₱30K or ₱50K/month, you’ll start weighing the graduated tax system vs. the 8% flat tax option.

👉 Every peso tracked in expenses (tools, bills, contributions) can reduce your taxable income.

Taxes may sting, but they also open doors freelancers often need.

Frugal Freelancer’s Reflection 📝

Let’s be honest—paying taxes in the Philippines doesn’t always feel fair.

Everyday, we already bleed money through the 12% VAT on basic goods, bills, and even Netflix subscriptions. Add to that news of billions lost to corruption (like the recent flood control project scandal), and many Filipinos wonder:

“Eh bakit pa ako magbabayad kung ninanakaw din naman?”

As freelancers, many of us juggle debts, family expenses, and goals of financial independence. I get it, I also agree that tax breaks or holidays would give honest taxpayers breathing space while forcing accountability on corrupt officials.

But here’s the thing:

👉 Filing and paying what’s due gives us legitimacy.

👉 Proper documents open doors (loans, housing, business).

👉 Integrity is something no corrupt official can take away from us.

Paying taxes doesn’t mean we support corruption. It means we’re doing our part while demanding the government does theirs.

Final Word

At ₱15K you’re tax-free (mostly), but the goal isn’t to avoid taxes forever, it’s to grow until paying them feels like a badge of honor.

💌 Want more no-BS guides and practical tips on freelancing in the Philippines? Subscribe to the Frugal Freelancer PH Newsletter

Disclaimer

I’m not a CPA or tax lawyer – just a frugal freelancer like you trying to make sense of the system. This guide is based on BIR’s published policies, but rules may change. For your specific case, consult BIR or a qualified bookkeeper/accountant.

P.S. Please note that some of the links on this blog may be affiliate links, meaning I may earn a small commission if you make a purchase or take an action through those links. This comes at no extra cost to you. I only recommend products or services that I personally trust and believe will add value to my readers. Thank you for supporting my blog!

No Responses